The COS method is very close to the more standard Heston quasi analytic formula (use transform of characteristic function for the density and integrates the payoff with the density, exchanging summation), except that the more simple Fourier series are used instead of the standard Fourier transform. As a consequence there are a few more approximations that are done related to the truncation of the domain of integration and the result is already discrete, so no need for a Gaussian quadrature.

In practice, the promise is to be faster. I was wondering how stable it was, especially with regards to short maturities/large strikes.

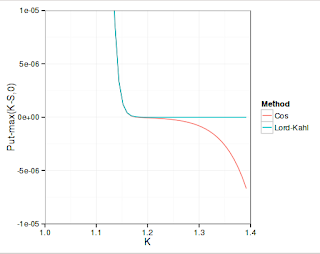

It's quite easy to code, I made only one mistake initially: I forgot to handle the first element of the sum differently. It is however very unstable for call options prices, because the upper integration boundary is then used in an exponential, which explodes in most cases I have tried, while for put options, the lower boundary is used in an exponential, and the lower boundary is negative.

|

| Price is too low at high strikes |

|

| Price is way too high at low strikes |

I was surprised to see that the more in-the-money put options also have inaccuracy: the price given is actually less than the final payoff. This is related to the domain of truncation. If I double it (L=24 instead of L=12), those disappear, what remains is that OTM puts can't go beyond 1e-12 for the COS method.

In practice the COS method was effectively 2x to 3x faster than my Lord-Kahl implementation. As a side note, on this problem, Java is only 2x faster than Octave.

As long as we don't care about very small option prices, it is an interesting alternative, especially because it is simple.

Update April 2014 - There is more information on the subject in my paper at http://papers.ssrn.com/abstract=2362968

The Lord-Kahl has actually a very different focus. The optimal alpha is quite strongly strike dependent. Pricing a list of options with different strikes and the same maturity will lead to very little reuse.

ReplyDeleteIn contrast the COS method evaluates the characteristic function at fixed points for given parameters and maturity, independently of the strike: most of it can be reused.

This can lead to another 5 to 10x speedup depending on the number of options for the COS method.

FYI, Fang is a woman

ReplyDeleteI actually found out that the Heston cumulants formulae are wrong in the paper.

ReplyDeleteHello Fabien could you post the Heston cumulants?

ReplyDeleteDear Fabien, could you please post the right cumulants for Heston?

ReplyDeleteI have written the right cumulants in the appendix of my paper around stochastic volatility calibration at http://papers.ssrn.com/abstract=2362968

ReplyDelete